The Circle of Hope Society is a special group of people who have included a gift to the Pediatric Cancer Research Foundation (PCRF) in their will or other estate plans. Donors of all income levels and financial capabilities can support PCRF through thoughtful gift planning. Your gift will make a difference for the future of innovative therapies and treatments for children battling cancer.

Thank you for making such a meaningful difference at the Pediatric Cancer Research Foundation (PCRF), by joining the Circle of Hope Society. By doing so you are helping to power cures and realizes futures.

Notify us of your planned giving commitments and you will be recognized as part of the Circle of Hope Society.

To include the Pediatric Cancer Research Foundation in your plans, please use our legal name and federal tax ID. Please let us know of your gift (many retirement providers assume no responsibility for letting nonprofits know of your intentions so your goals won’t be honored).

Legal name: The Pediatric Cancer Research Foundation

Legal address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal tax ID number: 95-3772528

To speak with a Planned Giving Expert at the Pediatric Cancer Research Foundation, please contact Jeri Wilson, CSPG

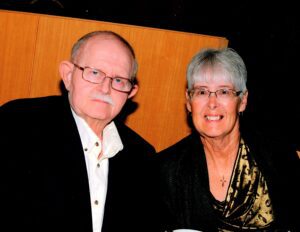

Make a lasting mark and leave a family legacy by naming the Pediatric Cancer Research Foundation in your estate. Besides the philanthropic satisfaction of making a gift to PCRF, there are significant tax benefits that may provide you with the opportunity to give more than you thought possible. For example, Patrick and Kaye Collins carefully planned their estate, ultimately making a considerable impact on PCRF in 2020. Initially getting involved through the holiday card program and then the National Corvette Restorers Society, the Collins’ saw the need for funding. So when they drafted their will decades ago, they decided to leave their entire estate to PCRF.

The impact of this gift allowed us to continue much-needed research in a year that offered up so much uncertainty. We invite you to join our Hope Society by including us in your estate plan, trust, gift annuity, insurance policy, or retirement plan. Please, help us plant the seeds for tomorrow’s cures to childhood cancer.

A Gift in Your Will or Living Trust

Interested in helping Pediatric Cancer Research Foundation with our mission but feel overwhelmed by the thought of writing another check or giving up your assets today? A simple, flexible and versatile way to ensure we can continue our work for years to come is a gift in your will or living trust, known as a charitable bequest.

By including a bequest to Pediatric Cancer Research Foundation in your will or living trust, you are ensuring that we can continue our mission for years to come.

Check out this Potential Scenario

Mr. and Mrs. McGurk became invested in the mission of the Pediatric Cancer Research Foundation through a friend who lost a son to cancer. They planned into their estate a portion of their assets to benefit Pediatric Cancer Research Foundation. In 2020, this gift allowed critical research to be advanced during a challenging fundraising landscape. PCRF is thankful for their generosity and forethought.

Learn How to Fund It

You can use the following assets to fund a bequest:

Next Steps

Legal Name: Pediatric Cancer Research Foundation

Address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal Tax ID Number: 95-3772528

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.

Beneficiary Designations

Passionate about supporting Pediatric Cancer Research Foundation with our mission even after your lifetime? It’s not only possible, it’s easy to do with a beneficiary designation. Just name Pediatric Cancer Research Foundation as a beneficiary to receive assets such as retirement plans and life insurance policies after you’re gone. You simply fill out a form that is entirely separate from your will—which makes this approach an easy way to give.

Not only is it an easy way to give, but it’s also flexible—you aren’t locked into the choices you make today. You can review and adjust beneficiary designations anytime you want.

Check out this Potential Scenario

Mr. Dupree specialized in financial planning, so it was only natural to consider his favorite charity in his planning even in the early years of his family life. Suddenly and unexpectedly, the life insurance plan he had set up with PCRF as the beneficiary was put into effect. Mr. Dupree’s designation of PCRF years ago allowed the donation to PCRF to transfer smoothly to the charity. His payments on this policy were also tax deductible during his lifetime.

Learn How to Fund It

You can use the following assets to fund a bequest:

Next Steps

Legal Name: Pediatric Cancer Research Foundation

Address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal Tax ID Number: 95-3772528

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.

Turn Your Generosity Into Lifetime Income

Charitable Gift Annuities

When you are looking for ways to help Pediatric Cancer Research Foundation with our mission, you shouldn’t feel like you are choosing between your philanthropic goals and financial security. One gift that allows you to support the mission of Pediatric Cancer Research Foundation while receiving fixed payments for life is a charitable gift annuity.

Not only does this gift provide you with regular payments and allow us to further our work, but when you create a charitable gift annuity with Pediatric Cancer Research Foundation you can receive a variety of tax benefits, including a federal income tax charitable deduction when you itemize.

Delay Your Payments

If you are younger than 60 or don’t need your payments immediately, you can set up a deferred gift annuity. This allows you to delay receiving payments until a later date—such as when you reach retirement.

Learn How to Fund It

You can use the following assets to fund a charitable gift annuity:

Next Steps

Legal Name: Pediatric Cancer Research Foundation

Address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal Tax ID Number: 95-3772528

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.

Charitable Remainder Trusts

Looking for a way to give Pediatric Cancer Research Foundation a significant gift? If you have built up a sizeable estate and are also looking for ways to receive reliable payments, you may want to check out the advantages of setting up a charitable remainder trust.

Benefits of a charitable remainder trust include:

There are two ways to receive payments with charitable remainder trusts:

The annuity trust pays you, each year, the same dollar amount you choose at the start. Your payments stay the same, regardless of fluctuations in trust investments.

The unitrust pays you, each year, a variable amount based on a fixed percentage of the fair market value of the trust assets. The amount of your payments is redetermined annually. If the value of the trust increases, so do your payments. If the value decreases, however, so will your payments.

Charitable Lead Trusts

Do you want to benefit from the tax savings that result from supporting Children’s Hospital, yet you don’t want to give up any assets that you’d like your family to receive someday? You can have it both ways with a charitable lead trust.

There are two ways charitable lead trusts make payments:

A charitable lead annuity trust pays a fixed amount each year to Pediatric Cancer Research Foundation and is more attractive when interest rates are low.

A charitable lead unitrust pays a variable amount each year based on the value of the assets in the trust. With a unitrust, if the trust’s assets go up in value, for example, the payments to Pediatric Cancer Research Foundation go up as well.

Next Steps

Legal Name: Pediatric Cancer Research Foundation

Address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal Tax ID Number: 95-3772528

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.

See Your Generosity in Action

Make a difference today and save on taxes. It’s possible when you support Pediatric Cancer Research Foundation through your IRA.

A Special Opportunity for Those 70½ Years Old and Older

You can give any amount (up to a maximum of $100,000) per year from your IRA directly to a qualified charity such as Pediatric Cancer Research Foundation without having to pay income taxes on the money. Gifts of any value $100,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference at Pediatric Cancer Research Foundation. This popular gift option is commonly called the IRA charitable rollover, but you may also see it referred to as a qualified charitable distribution, or QCD for short.

Why Consider This Gift?

Your gift will be put to use today, allowing you to see the difference your donation is making.

Beginning in the year you turn 72, you can use your gift to satisfy all or part of your required minimum distribution (RMD).

You pay no income taxes on the gift. The transfer generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions.

Since the gift doesn’t count as income, it can reduce your annual income level. This may help lower your Medicare premiums and decrease the amount of Social Security that is subject to tax.

Take Action! Give From Your IRA.

Frequently Asked Questions

For Those 59½ Years Old or Older

If you’re at least 59½ years old, you can take a distribution and then make a gift from your IRA without penalty. If you itemize your deductions, you can take a charitable deduction for the amount of your gift.

At Any Age

No matter your age, you can designate Pediatric Cancer Research Foundation as the beneficiary of all or a percentage of your IRA and it will pass to us tax-free after your lifetime. It’s simple, just requiring that you contact your IRA administrator for a change-of-beneficiary form or download a form from your provider’s website.

Tip: It’s critical to let us know of your gift because many popular retirement plan administrators assume no obligation to notify a charity of your designation. The administrator also will not monitor whether your gift designations are followed. We would love to talk to you about your intentions to ensure that they are followed. We would also like to thank you for your generosity.

Next Steps

Legal Name: Pediatric Cancer Research Foundation

Address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal Tax ID Number: 95-3772528

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.

Donor Advised Funds

A donor advised fund (DAF), which is like a charitable savings account, gives you the flexibility to recommend how much and how often money is granted to Pediatric Cancer Research Foundation and other qualified charities. You can recommend a grant or recurring grants now to make an immediate impact or use your fund as a tool for future charitable gifts.

You can also create a lasting legacy by naming Pediatric Cancer Research Foundation the beneficiary of the entire account or a percentage of the fund. With a percentage, you can create a family legacy of giving by naming your loved ones as your successor to continue recommending grants to charitable organizations. Contact your fund administrator for a beneficiary form.

Learn How to Fund It

Create a donor advised fund with one of the following assets:

Next Steps

Legal Name: Pediatric Cancer Research Foundation

Address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal Tax ID Number: 95-3772528

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.

In your work as a professional advisor, you value professionalism, integrity and honesty, taking the utmost care when serving your clients. As a nonprofit organization, we share your values and take the same care when it comes to helping our donors plan charitable gifts to Pediatric Cancer Research Foundation. Please use these tools as you help your clients with their charitable plans, and feel free to contact us for more information or assistance.

Partner With Us

We understand that gifts to charities such as Pediatric Cancer Research Foundation can be an important part of your clients’ overall financial and estate plans. That’s why we’re committed to working with you to ensure that your clients find the charitable arrangements that best meet their needs. We believe that charitable planning is a process that ideally involves the donor, professional advisors and our gift planning staff—all working together to arrange the best gift possible.

Next Steps

Legal Name: Pediatric Cancer Research Foundation

Address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal Tax ID Number: 95-3772528

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.

Contact Jeri Wilson at 949-859-6312 or jwilson@pcrf-kids.org for information to talk about the different options for including Pediatric Cancer Research Foundation in your will or estate plan.

Legal Name: Pediatric Cancer Research Foundation

Address: 2151 Michelson Dr., Suite 180 Irvine, CA 92612

Federal Tax ID Number: 95-3772528

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results.

2151 Michelson Drive, Suite 180, Irvine, CA 92612

800.354.7273 | info@pcrf-kids.org